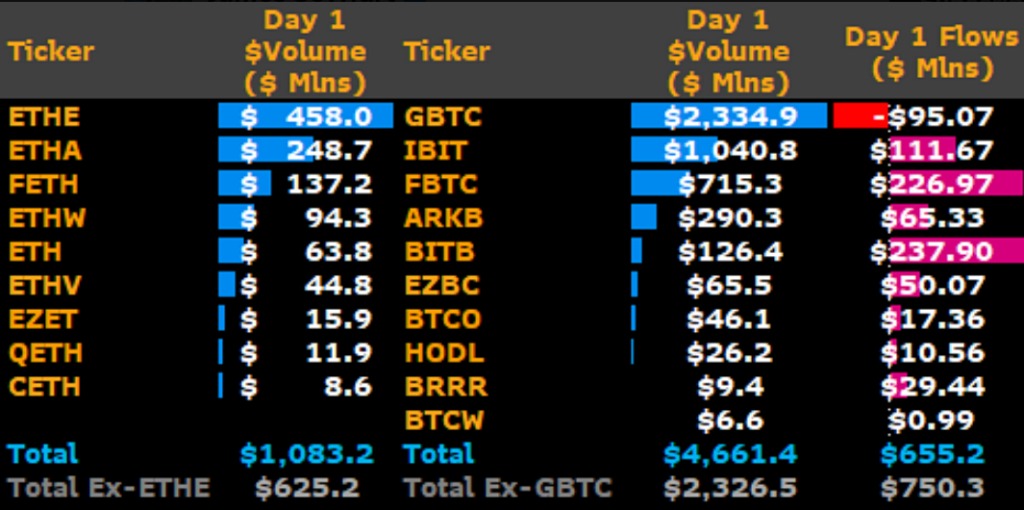

The recently launched spot ETH funds posted positive net inflows on the first day despite the outflows recorded from Grayscale’s Ethereum Trust.

Despite the massive outflows recorded from Grayscale’s Ethereum Trust, United States Ether exchange-traded funds (ETFs) posted a net inflow of $107 million on their first day of trading.

Unlike on the trading volume chart, where Grayscale’s Ethereum Trust took the first place. On the inflow chart, BlackRock and Bitwise’s ETFs took the lead. BlackRock’s iShares ETF (ETHA) saw $266.5 million and Bitwise’s Ethereum ETF (ETHW) with $204 million in net inflows.

Source: Farside.

However, Grayscale Ethereum Trust (ETHE), outflow recorded $484.9 million on the first day. This is because it was recently converted to spot ETF which made investors to easily sell their shares on the first day of launch.

Spot Bitcoin ETF had the same experience in January. In its case, Grayscale’s Bitcoin Trust (GBTC), saw over $17.5 billion in outflows following the launch of the 11 spot BTC funds.

The Trading Volumes Of Ethereum ETFs Top $1B on Day One

The trading volume Ethereum ETFs have exceeded $1 billion on the first day of launch in the United States. It is worthy to note that almost half of the volume is from Grayscale’s Ethereum Trust.

The trading volume Ethereum ETFs have exceeded $1 billion on the first day of launch in the United States. It is worthy to note that almost half of the volume is from Grayscale’s Ethereum Trust.

Trading volume is the total number of shares exchanged between buyers or sellers of an asset. This trade does not indicate inflows or outflows. It also does not tell the vision behind the trades as it does not identify whether it is long term or short term trades.

When compared with the trading volume of Bitcoin ETFs in January which saw $4.5 billion on its day of launch, Bitcoin ETFs recorded one-fifth of the first day volume.

On the volume chart, the most traded ether exchange-traded fund (ETF) on day one is the Grayscale’s Ethereum Trust (ETHE) leading with nearly half of the overall volume (1.077 billion).

Fidelity Ethereum Fund (FETH) followed suit with $292 million traded volume.

BlackRock’s iShares Ethereum Trust (ETHA) recorded $243 million in trading volume.

While the other remaining six funds saw below $100 million with 21Shares’ Core Ethereum ETF (ETHC) seeing the least trade on day one.

Source: James Seyffart

A clue on the level of demands of these products would be determined by the inflows which is yet to be indicated. The inflows will determine if the market would be bullish or bearish.

Read this: Basic things you need to know before trading Ether ETFs

UPDATE: ( July 24, 11:00 UTC): Adds details on Ether ETF outflows.