Crypto markets are facing increased volatility following a missile attack by Iran on Israel. This escalation, stemming from the long-standing conflict between the two nations, has sparked fears of a wider regional war. Iran’s assault was in retaliation for Israel’s incursion into Lebanon, targeting the Iran-backed Hezbollah group.

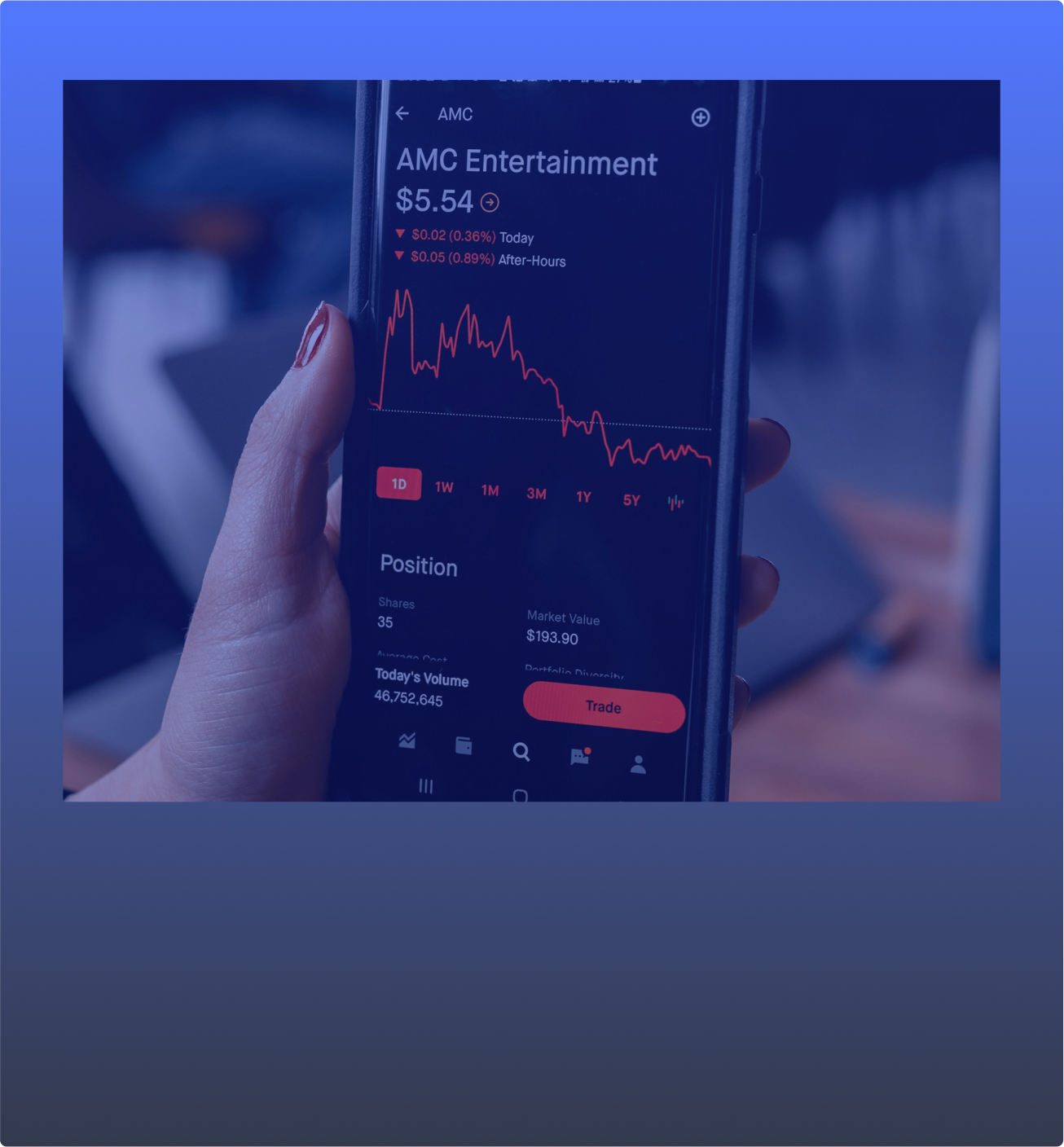

As geopolitical uncertainty rises, investors have started pulling out of riskier assets like cryptocurrencies and as a result Bitcoin (BTC) dropped by 1.7% on the day, reaching $62,000. Ethereum (ETH) and Solana (SOL) also experienced sharp declines, with Ethereum down 4% and Solana falling by 3.3%.

The crypto community, which had high hopes for a strong October market performance, known as “Uptober,” is now seeing those expectations waver. Historically, October has been a bullish month for Bitcoin, with average gains of 27%, but the geopolitical tensions between Iran and Israel have injected new risks into the market.

Beyond the immediate concerns, the broader macroeconomic environment remains optimistic. Central banks worldwide are easing monetary policies, and the US Federal Reserve’s dovish stance provides hope for a rebound in risk assets. However, until tensions in the Middle East stabilise, the crypto market could continue to experience downside pressure.

Despite the short-term challenges, some analysts still project Bitcoin could hit new all-time highs before the end of 2024, as geopolitical risks dissipate and macroeconomic factors favour recovery.