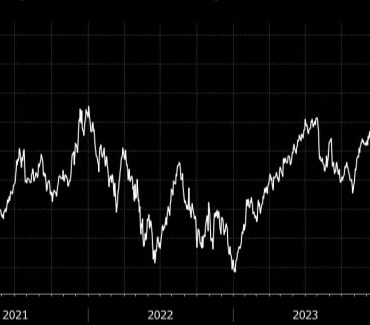

In the past 12 hours, the price of the leading digital asset experienced a significant decline. Initially, it dropped from $67,000 to $65,500. Shortly thereafter, another downward movement pushed it even lower, reaching a weekly low of less than $64,000.

Altcoins are currently experiencing widespread losses, with notable losses seen in ETH, DOGE, TON, AVAX, LINK, and various other cryptocurrencies.

BTC Falls Below $64,000

Following a volatile end to the previous business week, when BTC dropped to $63,000, the asset has been showing significant gains. It surged above $68,400 for the first time in over a month after President Joe Biden announced he would not run for re-election in 2024.

Bitcoin continued to experience volatility but mainly held above $67,000, unable to make a significant move towards the coveted $70,000 level. As of yesterday, it began the day trading above $67,000.

However, sellers pushed the price down to $65,500 at first, and then further down to under $64,000, which is the lowest since last Friday, despite some small increases in investments in spot Bitcoin ETFs.

Read latest update Bitcoin Stays Resilient Amid Tech Stock Drop, While Ether ETFs Falls.

Currently, BTC is just above $64,000, with its market cap dropping to under $1.270 trillion. However, its dominance over other cryptocurrencies remains strong at over 52%.

Following a positive start, spot Ethereum ETFs experienced significant outflows, particularly from Grayscale’s fund, on the second day. This led to immediate price declines for Ethereum itself, which dropped by 10% at one stage to reach a multi-day low below $3,150.

Other major altcoins like DOGE, SOL, BNB, TON, ADA, SHIB, LINK, DOT, and AVAX are also experiencing significant losses. However, XRP and TRX are among the few altcoins that have been relatively unaffected by the broader market correction.

With many smaller and mid-sized altcoins seeing significant losses today, the total cryptocurrency market cap has dropped by approximately $100 billion since yesterday, now standing at $2.420 trillion on CG.