Pavel Durov was detained by French authorities on August 24, 2024, upon his arrival at Le Bourget airport. The arrest was reportedly linked to multiple serious allegations, including the facilitation of illegal activities on Telegram, such as terrorism, drug trafficking, and child exploitation.

Durov and Telegram have long been advocates for privacy and freedom of speech, but these same features have now brought them under scrutiny, as law enforcement agencies argue that the platform is being used to shield illicit activities.

The news of Durov’s arrest quickly garnered responses from major figures in the tech and crypto worlds. Elon Musk and Vitalik Buterin, among others, criticized the arrest, arguing that it represents a broader attack on privacy and decentralization. Their criticism centres on the belief that holding a platform accountable for the actions of its users could set a dangerous precedent.

What Happened to TON After Durov’s Arrest?

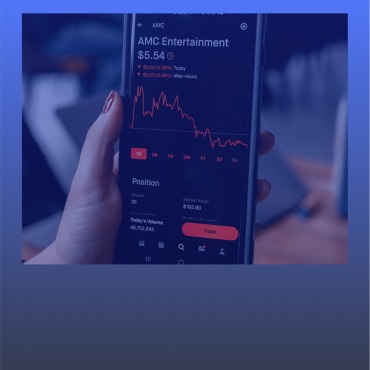

In the aftermath of Durov’s arrest, Toncoin (TON), the native cryptocurrency of the TON blockchain, plunged in value. Toncoin lost approximately $2.7 billion in market value, plummeting by about 20% in the days following the arrest. This sharp decline reflected the market’s anxiety over the future of Telegram and its associated projects, given that Durov is a central figure in both.

Despite these setbacks, the TON community has rallied in support of Durov, emphasizing their commitment to decentralization and freedom of speech. They have called for calm and unity, reassuring users and investors that the TON network remains operational and focused on its long-term goals.

Possible Scenarios for TON’s Future

- Legal Resolution in Durov’s Favor

If Pavel Durov successfully defends himself against the allegations, the charges could be dropped, leading to his release. This outcome would likely restore confidence in both Telegram and TON, potentially leading to a swift recovery in Toncoin’s value.

In this scenario, investors who held their positions during the downturn could benefit from the rebound. Investors might consider gradually increasing their exposure to Toncoin as confidence returns to the market.

- Prolonged Legal Battle

If the legal proceedings drag on, causing prolonged uncertainty, the market could remain volatile. The ongoing instability might deter new investors, and existing holders could become increasingly anxious.

Investors should consider adopting a cautious, long-term approach. Diversifying their portfolio to mitigate risk is advisable. Regular monitoring of legal updates and market reactions is crucial, as any significant development could trigger sharp price movements.

- Negative Legal Outcome for Durov

Should the legal case result in a conviction or severe penalties against Durov, the impact on Telegram and TON could be devastating. A loss of leadership might lead to a loss of direction for the TON project, causing a more pronounced and possibly permanent decline in Toncoin’s value.

In this case, investors should evaluate their risk tolerance. Those with a lower risk appetite may consider exiting their positions to prevent further losses. However, some risk-tolerant investors might view this as an opportunity to buy at greatly reduced prices, betting on a potential recovery or restructuring of the project.

- Community-Led Separation from Telegram

In the absence of Durov, the TON community could take the reins, emphasizing decentralization and pushing forward with development independent of Telegram.